Here is what happens when gold price rise unusually

Gold price has touched Rs 90,935 (10 gm 24K gold in Mumbai as on 18th March 2025).

Isn’t that amazing?!

In the last one year, gold prices have increased from Rs 67,495 (as on 19th March 2024) to Rs 90,935.

A whopping 34.72% returns in a year!

After looking at the numbers, gold is shining brighter than ever — soaring and breaking records.

Suddenly, everyone’s talking about gold. Your neighbour is considering buying gold coins, and that WhatsApp group you never check is buzzing with “gold tips.”

It feels like you’re missing out — but are you really?

The truth is, gold’s rise is captivating, but it’s not necessarily the golden ticket to wealth creation.

Let’s break down what’s driving this surge, why gold isn’t the get-rich-quick answer, and how you can grow your wealth without getting blinded by the glitter.

Why Is Gold Skyrocketing?

Gold’s price surge isn’t random — it’s a response to global chaos. When the world feels uncertain, investors seek safety. Gold has been the go-to hedge for centuries, and today’s drivers are no different:

1. Global Tensions and Fear

From escalating conflicts in the Middle East to tariff wars and political instability — the world feels like it’s on edge. Gold thrives when fear sets in because people look for stability, and gold feels like a safe place to park money.

2. The Dollar Is Weakening

The US dollar has been slipping, and since gold is priced in dollars, a weaker dollar makes gold more affordable for international buyers — boosting demand and pushing prices higher.

3. Central Banks Are Stockpiling Gold

Central banks around the world have been quietly adding to their gold reserves. Why? To protect their currencies from inflation and diversify away from dollar dependency. If the big players are buying, it’s easy to think you should too — but not so fast.

4. FOMO Is Real

When gold prices rise, media coverage follows. Suddenly, everyone’s talking about gold. The fear of missing out (FOMO) drives more people to jump in, creating a self-reinforcing cycle of rising demand and rising prices.

Gold’s Hidden Flaws

Yes, gold is up — but is it really the wealth-building tool it’s made out to be? Here’s the part that most people don’t talk about:

1. Gold Doesn’t Work for You

Gold just sits there. It doesn’t generate income, pay dividends, or grow through business expansion. Your wealth grows through compounding and gold doesn’t compound.

2. What Goes Up, Must Come Down

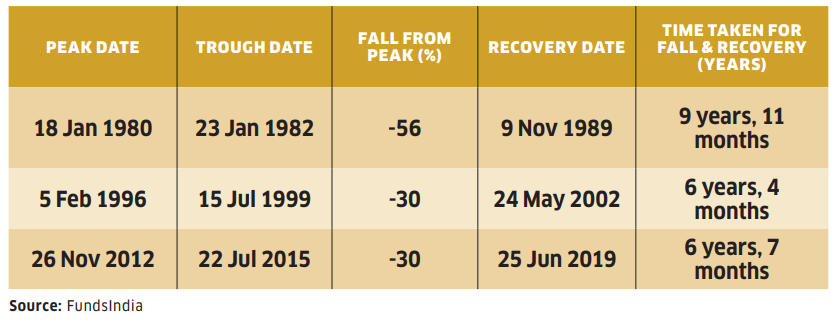

Gold isn’t a one-way street. Historical data shows that sharp gold rallies are often followed by steep corrections. When global fears settle, gold prices tend to retreat — and it can take years (9 to 6 years) for them to recover.

3. Timing the Market Is Tricky

If you think you can “get in at the top and sell at the peak,” think again. Gold’s price movements are unpredictable and influenced by factors beyond your control (like central bank policies and geopolitical shifts).

What Actually Builds Wealth?

The problem with gold is that it’s protection, not growth. It shields you during tough times, but it doesn’t create value. If you want to build real wealth, you need to think bigger:

1. Equities Create Value Over Time

Unlike gold, equities (mutual funds) generate returns through earnings growth, dividends, and business expansion. Over decades, equities have consistently outperformed gold because they create value — they don’t just store it.

2. Compounding Is Your Superpower

When you invest in equities, you benefit from compounding — where your returns generate more returns over time. Gold can’t do that.

3. Diversification Is Key

Smart investors don’t bet on one asset class. A balanced portfolio with gold for protection and the rest in equities for growth is a proven strategy for long-term success. Obviously get some insights from your growth manager before diversifying your portfolio.

Don’t Chase the Glitter — Build Real Wealth

Gold’s rise is tempting — but chasing it could leave you poorer, not richer. The real path to wealth isn’t about finding the next big win — it’s about building a portfolio that works for you, year after year.

Instead of reacting to gold’s surge, take a step back. Focus on a balanced, long-term investment roadmap. And if you’re unsure how to build that balance, talk to a growth manager. They’ll help you stay the course — because real wealth isn’t built overnight, but over time.Gold is shiny — but wealth creation is about the long game. Stay focused. Stay balanced. Stay the course.

Disclaimer: This content is for informational purposes only and should not be construed as investment advice.