Regret Minimization : The most underrated personal finance strategy

We all imagine a successful future. But the wiser question is – when you are 60, and you look back, did you use your health and income to build the life you truly wanted?

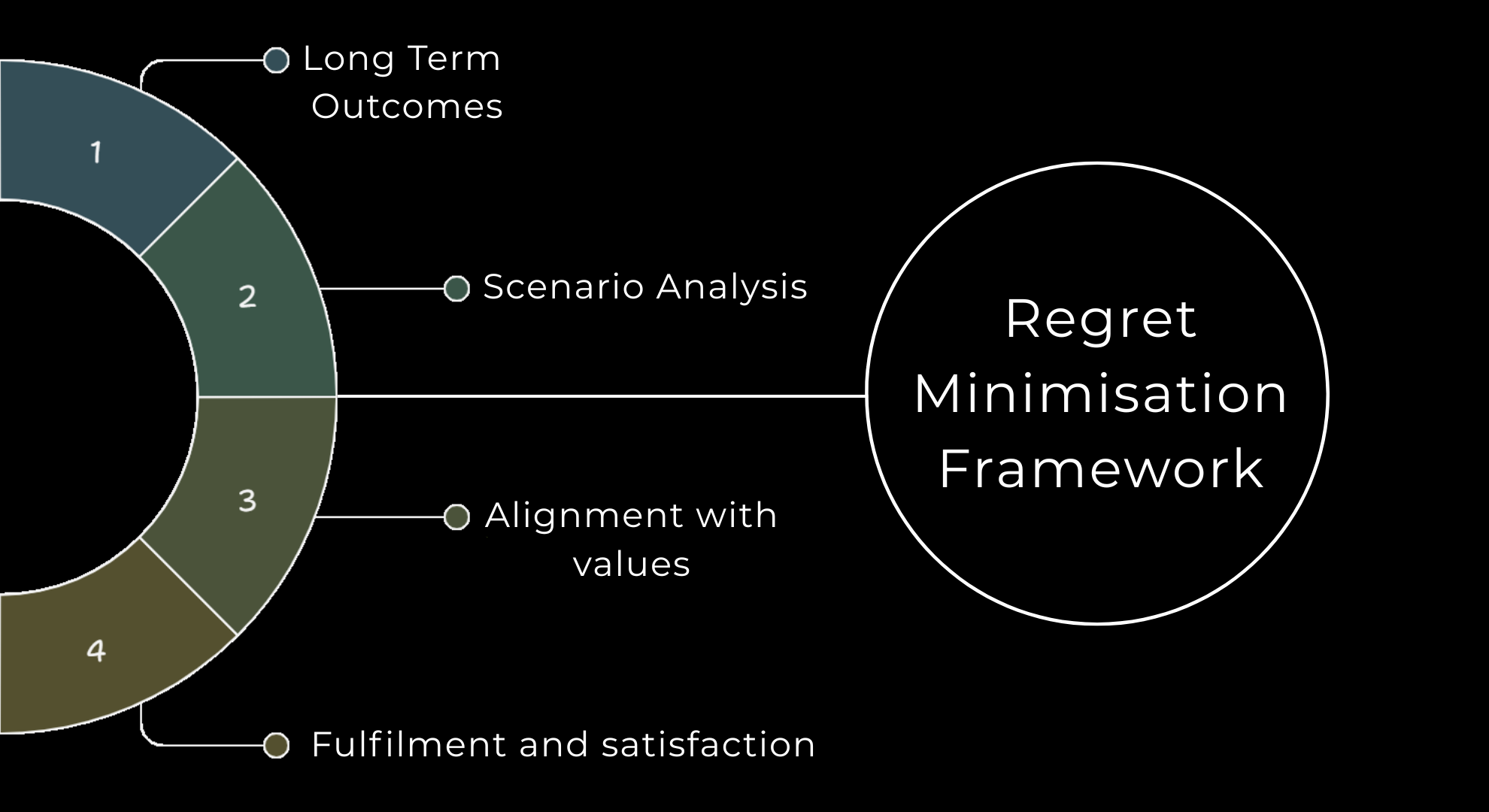

This is the essence of what Jeff Bezos popularised as the “Regret Minimisation Framework.”

“What would I regret not doing today?”

Why this matters?

Money decisions trigger two kinds of regrets:

- Regret of action: “I invested and lost.”

- Regret of inaction: “I never invested and missed decades of compounding.”

The second one hurts more because you can measure what your money could have become.

Its not about chasing returns but avoiding the future version of yourself saying,”I knew better, I just didn’t act.“

Where people underestimate?

Waiting for certainty before investing – Bezos built Amazon not by asking “What if it fails?” but “Will I regret not trying?”

For wealth, the same rule applies cycles reward early participation, not perfect certainty.The perfect time doesn’t arrive, it expires.

Avoiding equity due to market conditions– Many investors prefer debt, liquid, and arbitrage funds during volatile markets, perceiving them as safer. While these categories can reduce short-term volatility, they typically offer lower long-term growth compared to equity.

Thinking Income equals security -The most significant financial regret is rarely related to expenditure it is the missed opportunity to compound capital aggressively during peak earning and peak liquidity years.

Regret Minimization is a mindset, not a product play.

- Think in decades, not months.

- Automate habits that compound (sip’s, mutual funds)

- Allow wealth to grow quietly even when life is noisy

- Build assets before lifestyle, not after.

The real purpose of planning isn’t just to grow wealth, it’s to reduce the risk of reaching a later stage of life and wishing that critical steps had been taken.